Data Sheets

Springhouse Alternative Valuation Suite

A full range of accurate valuation services for residential and commercial origination, loan servicing, default, REO and secondary markets. Appraisals meet the interagency appraisal and evaluation guideline requirements.

Hubzu Short Sale Solutions

Altisource® offers a transparent and efficient short sale solution that can help reduce risk of fraud, increase sales proceeds and shorten your marketing and approval timelines through market validation and streamlined processes.

Springhouse Appraisals and Valuations

Looking for a smart way to obtain national, reliable and efficient valuation services? Consider Springhouse® — a nationwide valuations and data & analytics company.

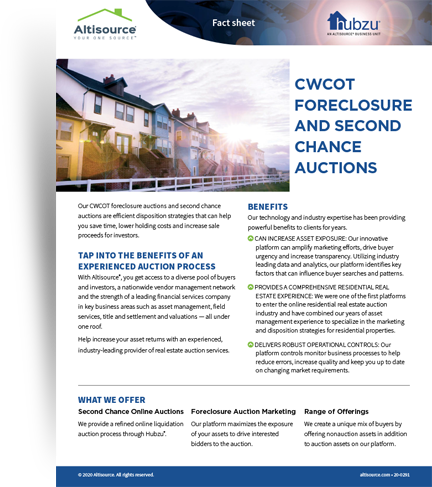

Hubzu CWCOT

Our CWCOT foreclosure auctions and second chance auctions are efficient disposition strategies that can help you save time, lower holding costs and increase sale proceeds for investors.

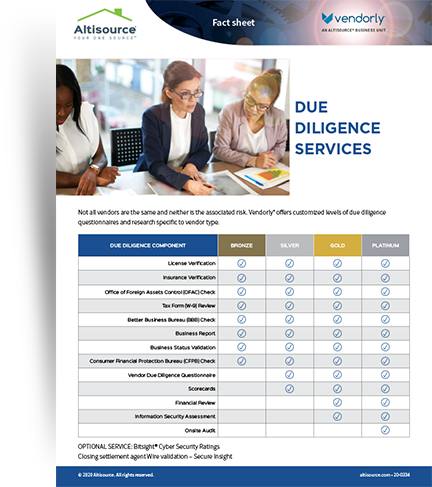

Vendorly Due Diligence Services

Not all vendors are the same and neither is the associated risk. Vendorly® offers customized levels of due diligence questionnaires and research specific to vendor type.

Vendorly ROI Cost Benefits

Leverage a shared due diligence network of 60,000 overseen vendors in the financial services and technology industry. By joining the Vendorly® network, experience economies of scale with industry standard oversight practices that are consistent across all clients. Our shared due diligence and connected profiles between users and vendors can result in reduced oversight costs and more consistent ongoing monitoring, helping to reduce third party risk.

SFR Solutions

Altisource® offers access to mortgage and real estate solutions that drive results. By combining industry best practices with leading-edge technology, we deliver economical and scalable solutions to the single-family rental (SFR) market. Our comprehensive solutions are highly customizable and tailored to fit your SFR portfolio strategy.

Trelix Mortgage Fulfillment Solutions

In today’s increasingly complex environment, you need a capacity management strategy that can do more than just help increase your mortgage fulfillment performance, meet compliance and lower investment costs. You need Trelix™ to seamlessly integrate our team of experienced employees with your mortgage operations. We want to build a relationship as your trusted source and provide an exceptional experience for every customer on every loan.

Altisource Call Center

Due to the CARES Act and other pandemic-related federal actions, banks are managing a surge of calls from borrowers asking about forbearance, repayment and loan modification plans. With unemployment and economic uncertainty at historic highs, those issues aren’t going away soon. Altisource® can help you maximize your single point of contact (SPOC) call capacity, increase performance, lower costs and improve customer experience.

Granite Inspection Services

Wherever you have a project, we have a qualified local inspector in place to complete the job.

Granite’s national network of certified inspectors are qualified and trained to deliver a comprehensive and standardized report regardless of location.

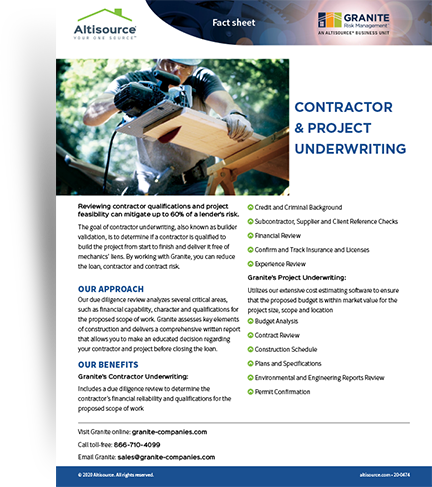

Granite Contractor and Project Underwriting

Reviewing contractor qualifications and project feasibility can mitigate up to 60% of a lender’s risk. The goal of contractor underwriting, also known as builder validation, is to determine if a contractor is qualified to build the project from start to finish and deliver it free of mechanics’ liens. By working with Granite, you can reduce the loan, contractor and contract risk.

Granite Funds Administration

Whether a simple TI or a complex ground-up, we deliver your project on-time, within budget and free of liens. Granite manages the labor intensive draw process so you can focus on what you do best. Using Granite’s Best Practices Risk Mitigation System®, we provide the centralized and standardized approach to risk mitigation.