Case Studies

Hubzu – CWCOT

Challenge

A top servicer wanted to improve the performance on its growing portfolio of delinquent FHA assets and decrease its conveyance costs.

Solution

The servicer used the Hubzu real estate marketing platform to market CWCOT foreclosure auctions and significantly improved auction conversion rates.

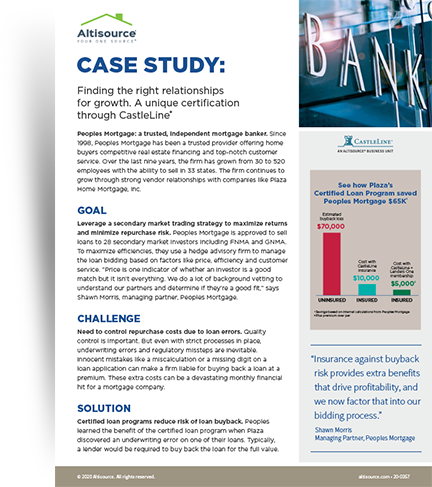

CastleLine – Peoples Mortgage

Challenge

Need to control repurchase costs due to loan errors.

Solution

Certified loan programs reduce risk of loan buyback.

Hubzu

Challenge

A medium-sized property management company faced significant obstacles in liquidating a large portfolio of properties.

Solution

Choosing Huzbu®, Altisource’s industry leading real estate marketing platform, provided this seller access to qualified buyers and increased asset exposure.

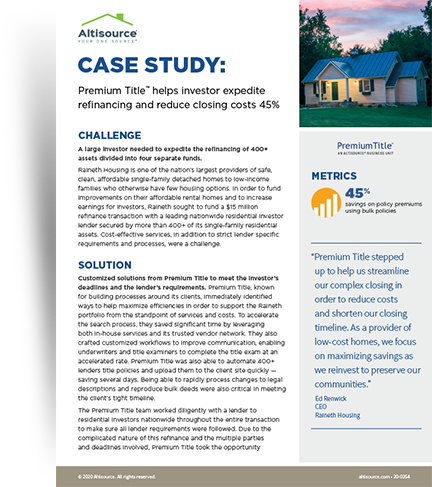

Premium Title – Bulk Services

Challenge

A large investor needed to expedite the refinancing of 400+ assets divided into four separate funds.

Solution

Customized solutions from Premium Title to meet the investor’s deadlines and the lender’s requirements.

Premium Title – CTPro

Challenge

A top-five national mortgage originator and savings bank (Bank) provided a construction-financing program as part of their customer offerings.

Solution

The Bank found a solution with Altisource’s Construction Title Pro® (CTPro®), powered by Premium Title™ and Granite Risk Management™.

Vendorly – NTFN

Challenge

NTFN sought to leverage a proven third-party risk management (TPRM) strategy to maximize their TPRM processes and minimize the risk presented by their large network of third-party vendors.

Solution

NTFN redesigned their vendor management program with Vendorly.

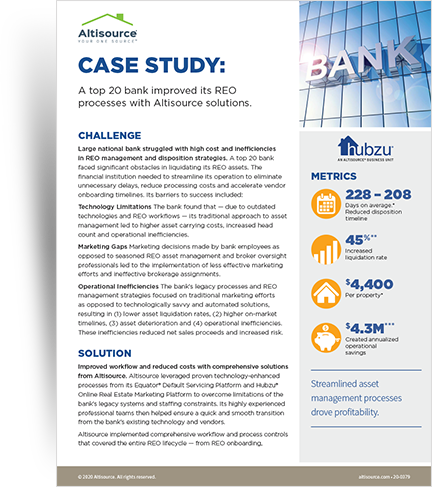

Hubzu – REO

Challenge

Large national bank struggled with high cost and inefficiencies in REO management and disposition strategies.

Solution

Improved workflow and reduced costs with comprehensive solutions from Altisource.