Data Sheets

Granite Inspection Services Data Sheet

Wherever you have a project, we have a qualified local inspector in place to complete the job. Granite’s national network of certified inspectors are qualified and trained to deliver a comprehensive and standardized report regardless of location.

REALSynergy Commercial Servicing

The REALSynergy® platform is a highly automated, commercial real estate and multi-family loan servicing platform capable of effectively managing virtually any loan structure, including government servicing entity (GSE) and CMBS deals.

REALSynergy Data Import Utility

REALSynergy’s Data Import Utility (DIU) tool was created to import loan data into the REALSynergy® Commercial Loan Servicing System. DIU can be used to import borrower, loan, real estate and escrow data from Excel® and CSV file formats into the REALSynergy Loan Servicing System database through a simple wizard interface during initial system setups. This tool may also be used for boarding large servicing transferred loan pools into REALSynergy.

REALSynergy Web Loan View

You have enjoyed the immense benefits of this servicing solution — now allow your investors and borrowers 24/7 access to their commercial loan information via your website. Web Loan View is an easy-to-maintain product that offers unlimited user access. Reports can be quickly generated with ease and exported to MS Excel® for manipulation or can be exported in Adobe® PDF.

REALSynergy General Ledger Interface

The REALSynergy® platform is a highly automated, commercial real estate and multi-family loan servicing platform capable of effectively managing virtually any loan structure. Developed for servicing professionals by servicing professionals, Altisource® Portfolio Solutions prides itself on providing its clients with innovative technology solutions. REALSynergy’s General Ledger (GL) Interface allows users to consolidate transactions posted in REALSynergy according to the company’s appropriate general ledger chart of accounts.

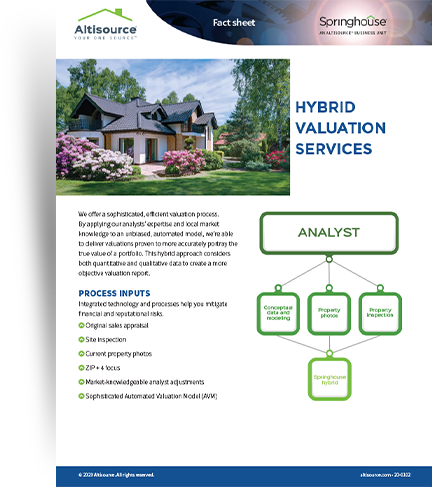

Springhouse Hybrid Valuation Services

We offer a sophisticated, efficient valuation process. By applying our analysts’ expertise and local market knowledge to an unbiased, automated model, we’re able to deliver valuations proven to more accurately portray the true value of a portfolio. This hybrid approach considers both quantitative and qualitative data to create a more objective valuation report.

CastleLine Risk Management and Insurance Solution

In today’s highly regulated landscape, mortgage underwriting errors and fraud are more costly than ever and defect-driven reviews are leading to more repurchases of performing loans. CastleLine’s Certified Loan Program helps protect you from losses arising from loan manufacturing defects, underwriting errors, misrepresentation and borrower, seller and employee fraud.

Trelix Mortgage Closing Services

Receive a fast and accurate closing experience — including document preparation and closing coordination.

Trelix Loan Due Diligence

Trelix™ Loan Due Diligence is a mortgage risk solution to help improve your correspondent platform, giving you accurate information needed to price, acquire and service loans.

Trelix Efficient and Scalable Workforce

Trelix™ helps you improve loan process efficiency and reduce risks in an increasingly complex environment. Our scalable workforce provides additional resources to assist key areas in your mortgage fulfillment platform — loan setup, loan processing, underwriting, quality control, closing and post-closing review.

Trelix Mortgage Processing Services

Help ensure the timeliness and improve all loan documentation before you reach the underwriting stage. The scalable power of a global workforce means Trelix™ can review all file documentation for accuracy and validate that items are correct and accounted for.

Trelix Quality Control Services

Reduce your loan origination risks by ensuring tight quality control with our Trelix™ Mortgage Fulfillment Services. Trelix ensures compliance with agency and lender requirements. We’ll alert you of any issues that may put your business at risk and help protect you against flaws and fraud. We can even train your staff and educate your organization.